After successfully deploying ClickOnSite, our telecom infrastructure management software, at the major telecom players in Europe (Orange Group, TOTEM, Altice, TELE2, etc.) Africa (MTN Group), and South-East Asia (Panasia, IGT, etc.), we are now launching an ambitious strategy in Latin America. A telecom marketplace that will increase at a CAGR of 2.5% between 2021 and 2026 (1).

A strategy of conquest with a 360° action plan

As always, IT-Development is committed to providing a quality and customized service. The ClickOnSite launch on the Latin American market is no exception to these rules. A 360° action plan has been initiated to support this strategic decision and our customers across the Atlantic as closely as possible.

A Spanish version of ClickOnSite

First of all, from a technological point of view, ClickOnSite has been fully redesigned to deliver a Spanish-language version. This was done to facilitate the adoption of the tool by local users.

A qualitative service with native Business Analysts

The relationship between our Business Analysts and our clients is essential to enable the best adoption of ClickOnSite. For this reason, native Latin American Business Analysts have been specially recruited to support the service team and integrators in their daily tasks and projects. Thus, we can ensure a clear and efficient understanding of local issues, all in a perfect native language.

A large-scale marketing campaign

To support this new implantation, IT-Development’s marketing teams started to break the news during our Mobile World Congress 2022 exhibition. This first step was the beginning of a large-scale communication campaign launched in mid-March, in collaboration with the Deveo agency, to mobile network operators and towercos in more than forty countries. In addition, a dedicated website and a ClickOnSite brochure were created in the Spanish language.

Latin America: the promising market despite the health crisis

A market weakened by the COVID-19 pandemic but still attractive

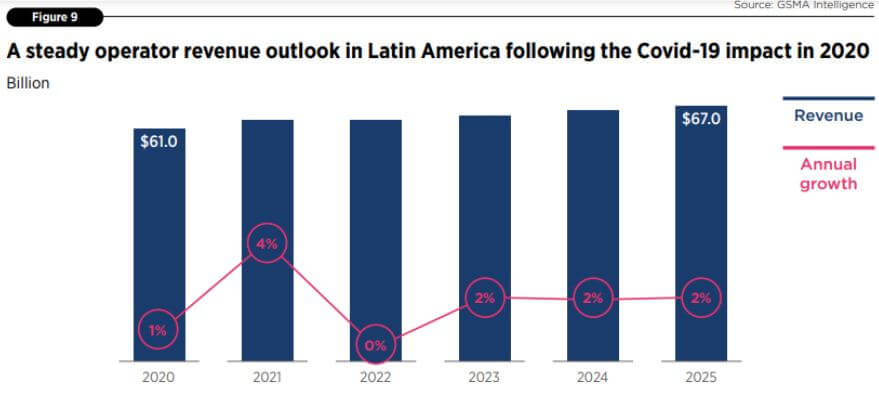

While the pandemic has had a significant impact on Latin American nations, regional telecom infrastructure players and MNOs are struggling with the consequences of connectivity, data consumption, and investment limits. Nevertheless, the market did well in 2020 and 2021. The economic impacts are much noticeable on the annual growth of operators from the year 2022. But the GSMA revealed in its last report dedicated to the LATAM market that this decrease is evaluated in the short term (2).

5G and digitalization as strategic challenges

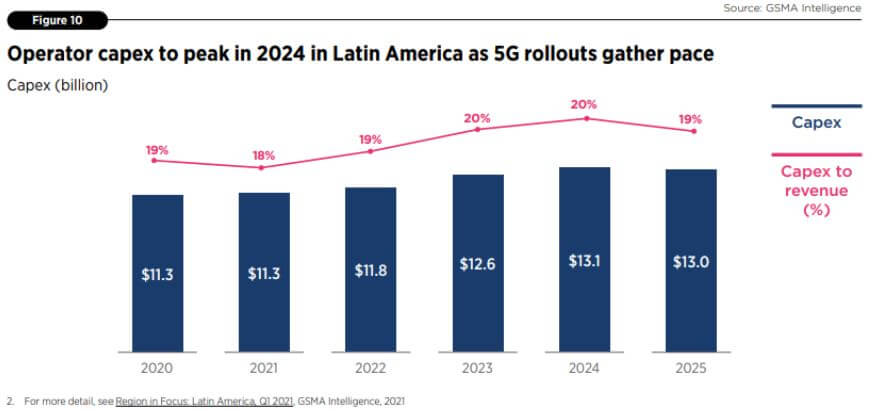

In Latin America, 5G is still in its beginnings, the operators are mainly engaged in migrating 2G and 3G consumers to 4G networks. 4G adoption in the region is continually increasing and is not predicted to peak until 2024. That’s why the deployment of 5G networks has been postponed for several years. And, GSMA predicted that 5G will account for just 25% of mobile connections by 2026. But, revenue generation, efficiency, and customer experience are driving the network transformation activities of the actors in this zone. To do so, MNOs will invest more than $70 billion in their networks between 2020 and 2025 to boost 5G. This will be a major driver of this spending, responsible for about two-thirds of network CAPEX throughout the period.

Sources:

- Analysys Mason report: Latin America telecoms market: trends and forecasts 2021–2026

- The mobile economy Latin America 2021 by GSMA : https://www.gsma.com/mobileeconomy/wp-content/uploads/2021/11/GSMA_ME_LATAM_2021.pdf

- TowerXchange CALA 2021

- Telecoms as an Investment in Latin America: COVID-19 Impact and Opportunities by OMDIA: https://centroi.org/wp-content/uploads/2021/01/Telecoms-as-an-Investment-in-Latin-America-PDF.pdf