Overshadowed by GDPR, the new IFRS 16 lease compliance regulation is a bigger issue for MNOs & Towercos

Thank goodness the flood of emails about GDPR compliance is over!

However, for any company in the telecommunications industry which deals with leases, a more important new international compliance regulation is coming in January 2019: IFRS 16 *.

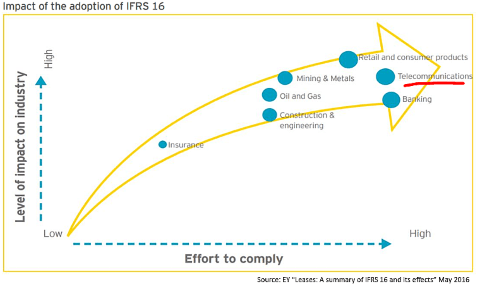

Head’s up!: EY says that of all industries affected by this new regulation, telecommunications is at the top of the scale for both high impact on the industry and high effort to comply, see graphic above. (source: EY “Leases: A summary of IFRS 16 and its effects”)

What is it (aka FASB/IASB)?

This is a major reform in financial reporting where companies must disclose on their financial statements all of their leased assets. In summary:

- Lessees will have a single accounting model for all leases, meaning huge assets and liabilities on the face of their balance sheet and a big change in their earnings curve (with two exemptions: “low-value assets” and short-term leases)

- There are additional disclosure requirements

- Lessor accounting is substantially unchanged

What does it mean for MNOs & Towercos?

IFRS 16 applies to basically all types of leases used in the telecommunications industry, for example:

- Tower leases

- Ground leases

- Car fleets

How does ClickOnSite help you with IFRS 16?

ITD recognized the impact of this change on our customers, and the industry, and we did two things right away:

- We modified the ClickOnSite data model to be compliant with the new regulation

- We teamed up with Blimp 360, a web-based system for global management of leases with native compliance of the regulation designed by IFRS experts, to create a seamless integration of leases accounting in ClickOnSite, and to manage the transition to IFRS 16

How does the ClickOnSite – Blimp 360 integration work?

There are two steps to managing leases information:

- Collection: In ClickOnSite, you collect and store your lease information and terms

- Processing: Blimp prepares the data and delivers proper accounting statements and entries (by entity, by contract, by cost center)

The integration between ClickOnSite and Blimp 360 is seamless and easy for you:

- Your site acquisition team records the lease information in ClickOnSite, as usual

- Your legal team validates the terms, as usual

- The lease terms are automatically transferred from ClickOnSite to Blimp 360 for processing.

- also, Blimp 360 calculates your monthly budgets and provides various forecasts

- ClickOnSite triggers payment notifications to your ERP

In short, ClickOnSite is ready for IFRS 16 and we can make it easy for you to deal with this change!

Will you have your leases accounting for all your sites by January? If you are not sure, contact us!

#MakeTheEverydayBetter

*Find more information at www.ifrs.org.